The W5 Narrative

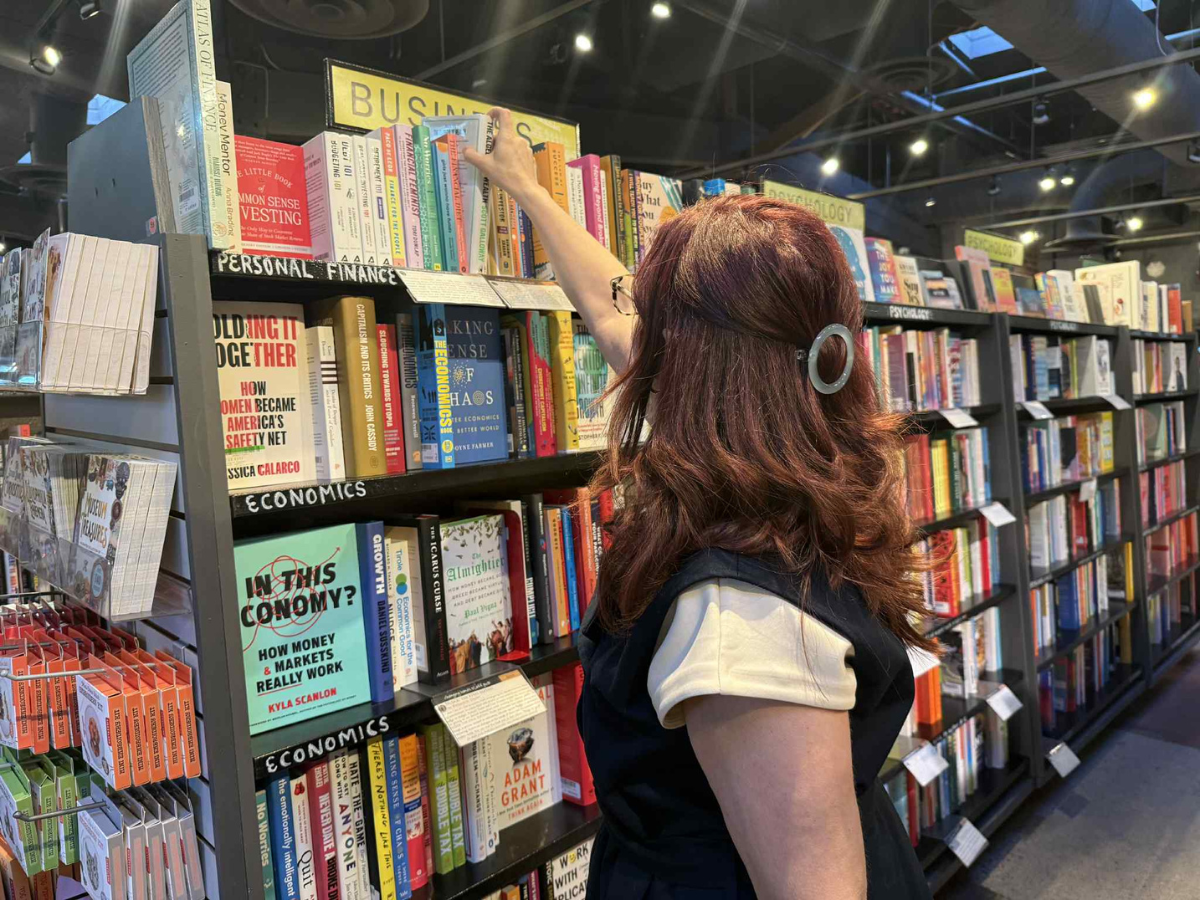

The Value of Trade Pros in MR

Explore how trade professionals can bring unmatched real-world insight to market research by translating on-the-ground experience, supplier dynamics, and buyer behavior into practical intelligence.

New Year, New Look Back?

A new year invites both reflection and foresight. Rather than chasing bold predictions alone, this piece explores what recent shifts tell us about where research, brands, and consumer behavior are truly headed.

2026 TTRA Marketing Outlook Forum (Meet Us There)

Join W5 at the 2026 TTRA Marketing Outlook Forum!

POV of a Researcher: The Value of Connection

Behind every interaction, digital or in-person, there’s a human to understand. Dive into how we uncover the small but meaningful moments that influence decisions every day.

One Size Doesn’t Fit All: The Art of Engaging Distinct Audiences

The best insights don’t just come from asking better questions, but from understanding who’s answering and designing the research to meet them where they are.

Spotlight: Avoiding Pitfalls with Purposeful Creative Testing

In this spotlight, we explore how W5 used a hybrid research approach to evaluate and refine a client’s brand identity and creative strategy.

Scoring with Gen Z Soccer Fans

Soccer has grown into more than a sport, becoming a global force that shapes culture, identity, and community. As younger audiences redefine what it means to be a fan, brands need fresh strategies to connect, inspire, and stay relevant leading into the 2026 World Cup.

Shorter, Sharper, Smarter: Why Short Surveys Outperform Long Ones

When it comes to surveys, bigger isn’t always better. Splitting one long, bloated questionnaire into shorter, focused studies not only improves data quality and respondent engagement, but also delivers sharper insights that roll up into one clear, strategic story.

Why Creative Testing is More Important than Ever

Join us as we explore the importance of creative testing and share recent work showing how qualitative research equipped our agency partner with the insights to refine, optimize, and successfully launch a new campaign.

Travel Light, Travel Smart: Lessons From the Backpacker’s Mindset

Travel light, travel smart. Whether hiking the John Muir Trail or racing through O’Hare for a client meeting, the biggest lesson I’ve learned is to travel with a backpacker’s mindset - prioritize essentials, stay adaptable, and embrace discovery - and how it applies to marketing research.